HK property stocks – time to shine vs HSI and physical?

Now that we have concluded in Part 1 that property stocks will outperform inflation in the next few years, we need to consider whether the larger stock universe, say represented by the Hang Seng Index (HSI) or underlying property could do even better. Here we delve into the relative merits of various peer classes.

We are more bullish on property stocks than the underlying

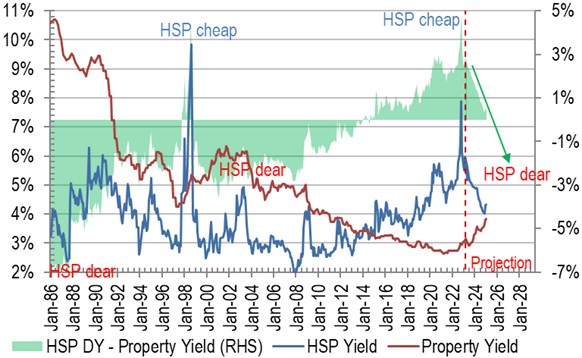

Deploying similar yield differential study between the HSP and residential property, we can detect four distict turning points in the relative values between HSP and physical: mid 80s and early 2000s stock peaks (red texts) and 1998 and 2022 (ie now) troughs (blue texts) when HSP reached at their cheapest extremes against physical:

Chart 1: HSP yield swings from one extreme to another, we seem to be at the cheap extreme right now

Our technical analysis derived rental yields should see the value go from c.3% now towards 4% handle by 2025, while the extremely high 5-6% returns on HSP should swing the other direction when the huge stock premium (green area in Chart 1) turns into a discount. We project that by end 2024, HSP dividends would still be higher than property rents in yield terms, and likely to trade lower towards the other extreme around 2026 (green arrow in chart).

Property stocks should beat other sectors not holding real assets

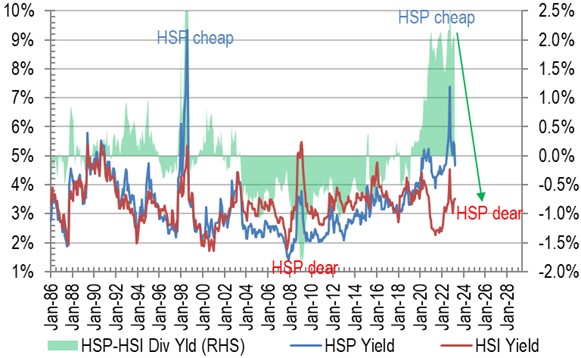

The massive tech bubble driven by zero interest rates and QE of the last five years is now over, and we should now see a period of persistent tech underperformance given how the yield relative is at an all-time high (Chart 2). Indeed, the distortion is also the most extreme thanks to covid policies (endless govt handouts and deficit spending while rates were kept at zero). When this valuation anomaly swings the other way, we will see a period of very strong property stock outperformance:

Chart 2: The record dividend difference between HSP and HSI suggests HSP is very under valued

If the yield premium shrinks from the 2% region to -0.75% end (which was the norm during 2003-2015, then some significant outperformance might be in store for the HSP… The current cheapness of physical asset (as represented by high yields in HSP) could be further exacerbated if we consider the new deglobalisation trend where lockdowns and geopolitics may reduce the earnings (and thus returns) of trading/finance related sectors much more than the beaten down property sector.

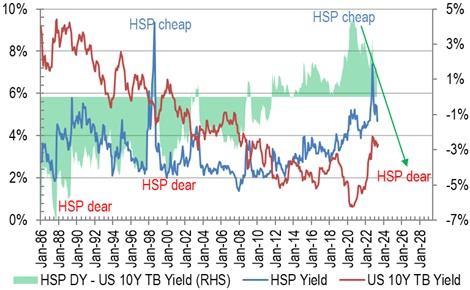

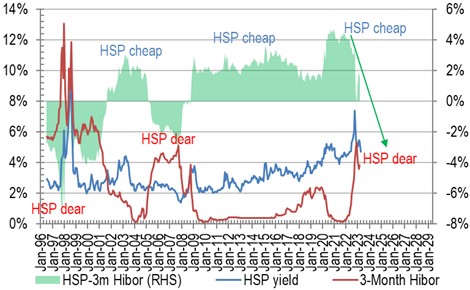

HSP a safe haven vs govt bonds

At the most liquid end of the peer spectrum, we come to govt bonds as the final leg of analysis for our study. Here the relentless underperformance of the property stock sector (since 2013) reached a peak in 2022 when HSP yields breached 7% (blue line in Chart 3 & 4). However, the reversal in bond yields also began in 2022 when treasury as well as interbank rates spiked the most in the last 40 years, precipitating a reversal in yield premium for HSP vs bonds/bank rates. If this reversal is taken to their respective extremes in the next 3 years or so, we could see HSP also outshine bonds or even deposits…

Chart 3: The HSP yield premium vs US TB should see massive narrowing in coming years

Chart 4: … similarly for HSP yields against HIBOR

All this could point to a very unusual set of circumstances – in the next two years or so, that despite being rate a sensitive sector, HK property stocks are probably at its most resilient compared to all its main rival asset classes, and could be a real safe haven in the turbulent world we will soon enter, even if we factor in some punchy drops in rents to come in such a chaotic environment, because the prices are pricing in so much distress already…

The author would like to thank Chen Hailan from The University of Hong Kong majoring in Economics and Finance, Leung Kin Tung Sam from The Chinese University of Hong Kong majoring in Quantitative Finance, and Wong Ngai Fung Wallace from The University of Hong Kong majoring in Wealth Management for assisting in data collection, analysis, and drafting this article.