With the record smashing office land sale last week in Central where both the lump sum and unit price hit all-time highs (HK$23bn and HK$50,000 per square foot respectively), it seems an opportune moment to look into the dynamics of commercial land supply in Hong Kong.

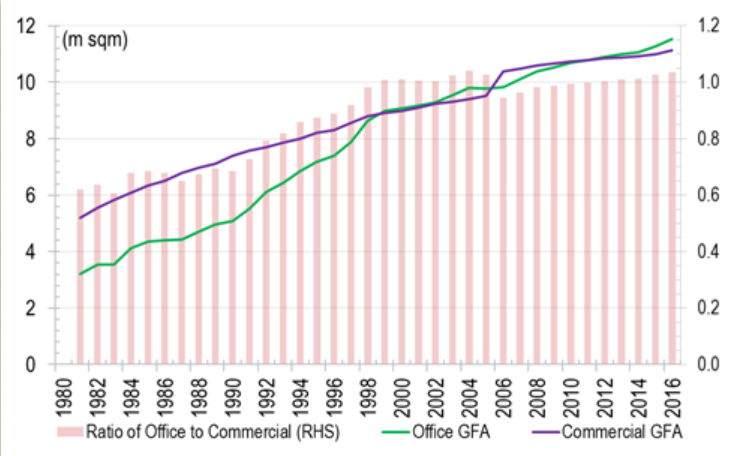

As can be seen in Chart 1 below, both the office stock and retail space have been growing steadily in the past three decades. However, one cannot fail to notice that the speed of growth in office space has been outpacing that of retail consistently – this has led to the office-retail stock ratio rising from 0.62x in 1981 to 1.04x in 2016 – a massive outperformance of 69% over the entire period.

Last week’s record high office land sale price tag may be due to a combination of factors, including an ultra-low interest rate environment, increasing demand from China’s burgeoning corporate sector looking to expand overseas (via HK), thereby pushing up rents and prices here.

However, this could be said for retail space also, where ever rising PRC tourists should have done the same to retail property demand, so why has office still raced ahead in its stock build up, leaving retail in the dust?

Shifting consumption pattern: from goods to services

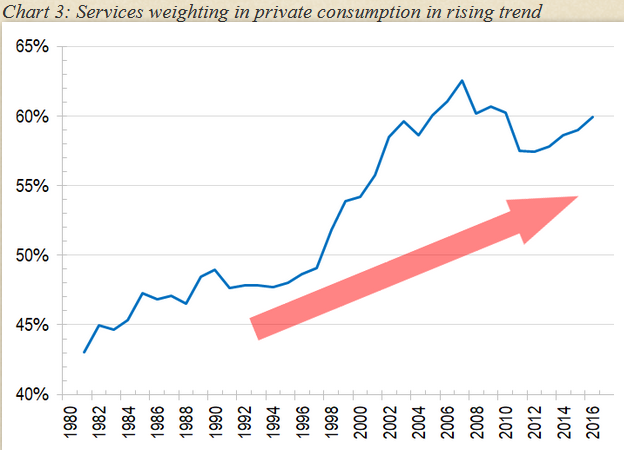

We suspect that the faster growth in office inventory compared to retail space may have something to do with the changing mix of the Hong Kong economy at large, where a greater part of consumption is now undertaken in the form of services rather than goods alone.

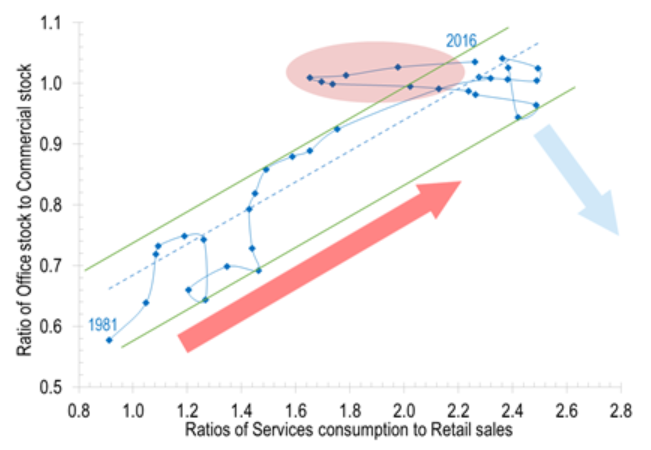

By comparing service consumption dollar to retail dollar over the years, it becomes apparent that services have grown significantly faster than retail – from 0.9x of retail back in the 80s to around 2.5x in the noughties (X axis,Chart 2). Throughout this period, there seems to be a matching growth in the ratio of office stock versus retail space (Y axis). Apart from a short period of volatility where the service-retail ratio fell in the past 4-5 years (red oval), likely caused by a disproportionate explosion of mainland visitor numbers, the relationship has held very neatly in a linear fashion.

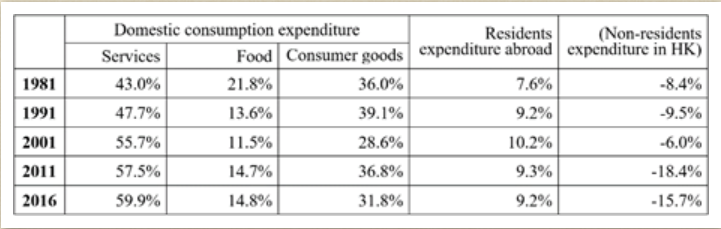

Looking more closely at the total consumption picture, we could see that the amount of services related consumption, which is largely produced, if not also consumed in office premises, has risen from 43% in 1981 to 60% now; over the same period, the more retail space intensive items of Food and Consumer Goods have seen their combined share drop from 58% to 47% (Table).

Table: Components and their weights in private consumption

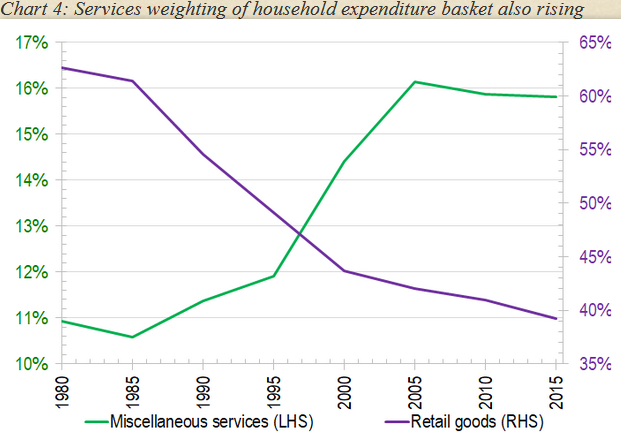

This rising trend of services consumption can be visually represented in Chart 3 below, in fact, even the basket of household expenditure used to survey inflation has also witnessed a general drop in weighting for goods specific items (food, drinks, clothing and durable goods – see purple line in Chart 4) over the years.

From bricks and mortar to clicks and mortar

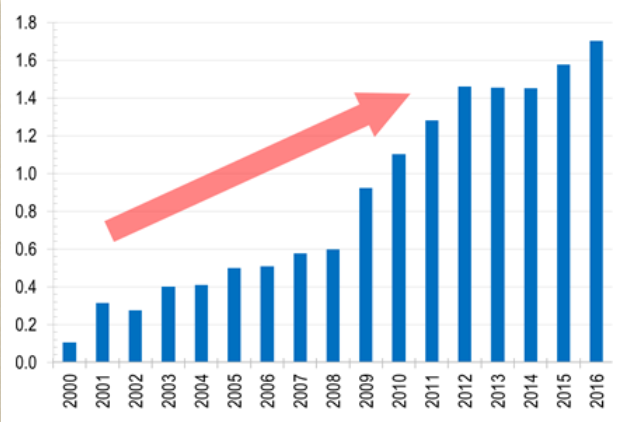

Another new trend that has emerged in recent years is the exponential growth of online retail (Chart 5), meaning that increasing proportions of retail purchases may now be taking place in offices (eg online sales handling by e-commerce staff) and industrial/warehouse spaces (which supports the logistics of the online retail sales), this will obviously become more important in influencing demand for both office and retail space in future.

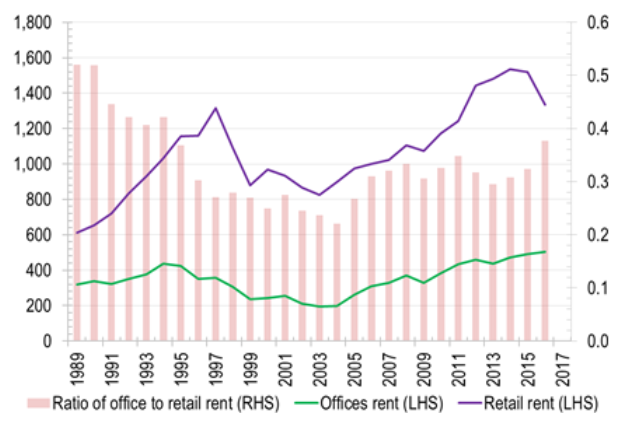

Why has office rent not outperformed retail then?

Given the faster rising demand for services, one might ask, why then has office rent not done significantly better than retail rent (Chart 6). The simple explanation could be that office stock has grown faster than retail space at the same time, keeping the magnitude of office rent increases in check.

A more physical reason may be that office space can be stacked over many storeys without affecting its utility, while retail premises require large pedestrian foot traffic, convenient transport linkages, and high location visibility to be of value to retailers. This explains why retail facilities in most multi-storey commercial buildings are restricted to the lowest floors (often not more than three).

But what of the future? Will office supply continue to outpace retail? Not necessarily, for two reasons: 1) as the increase in PRC tourist arrivals recover and potentially reach new highs, more specialty themed multi-storey shopping malls may be built, or converted from office blocks, provided the logistic issues of large foot traffic flows can be addressed; and 2) the new trends in mobile working and hot desking could reduce the need for office space at a per-worker level (e.g. some organisations expect >10% utilisation improvements in their office space by moving towards a hot-desking/co-location model), not to mention the emerging phenomenon of robo-workers and their threat to white collar professions.

Whatever the future holds, Hong Kong remains a hub of regional activity for both office and retail, and will only benefit from further above-average growths of the Asian economies. In that regard, both subsectors should see trend outperformance compared to other global office/retail hubs in more mature cities.

With special thanks to Miss Rhonda Zixuan Lai (賴子萱) for her contribution to this article.