Good 2021 growth figures, but…

After the atrocious contractions of 2020 thanks to lockdowns, recent forecasts on 2021 GDP have turned distinctly rosy, ranging from 3.3% to 4.2% and averaging 3.8% growth.

However, given the traumatic falls of 2020, these growth figures may still not be enough to take us back to pre-lockdown levels, and the chart below demonstrates this disconnect due to base effect:

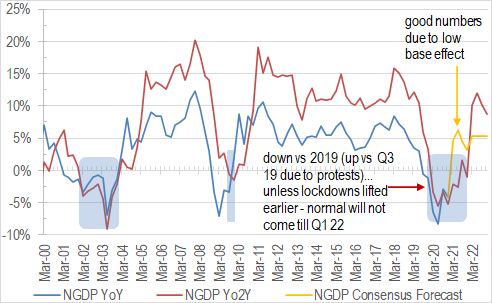

Chart 1 : YoY economic growth forecasts mask low base in 2020

The year-on-year growth in GDP (blue line above, extended by forecasts of 2021 represented by yellow line) may appear strong, but if we were to compare this year’s performance to pre-lockdown levels, as represented by 2-year changes (red line) , normalcy will not return until Q1 22. The positive blip in the red line in Q3 21 is the result of a bad comparable Q3 19 when the street protests disrupted economic activities.

In fact, the current recession looks much more like the post-dot-com/SARS one in 2001-3 than the GFC episode in 2009-10, as the latter bounced back much faster. Given the shape of the current recovery, 2021 will remain below 2019 levels for sure, and probably 2022 as well.

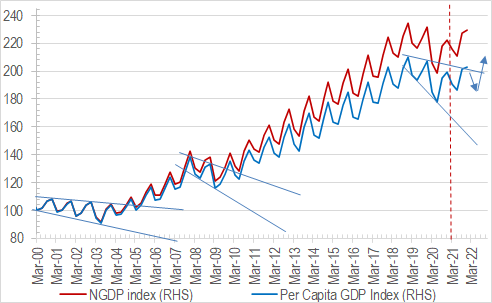

Return to 2018 unlikely until 2023 at the earliest

So when is the most likely time we will see the economy return to pre-lockdown days? Perhaps not widely known, HK’s economy actually peaked in 2018, and has been on a downtrend in 2019 (protests) and 2020 (lockdowns), this year’s recovery is yet uncertain, as it depends on how quickly the govt reopens the economy to normal business.

Even assuming immediate opening, which most market forecasts probably factored in already, we are unlikely to see the economic level return to 2018 peak levels until 2023, as the arrows in the chart below suggest:

Chart 2 – Indexed GDPs suggest return to 2018 peak after 2022

If lockdowns are extended, or global travel opening were delayed, the 2023 recapturing of prior high becomes even less probable. As a reference to the last big recession – the 2000 peak was only recaptured in 2004; we reckon the 2018 peak will most likely be retaken in 2023 at the earliest, if the side effects of lockdowns/money printing/supply chain destruction do not stoke second order economic problems or worse political unrests before we get there.