Is high inflation upon us? How will HK rates / home prices be affected?

Inflation may rise far more than expected

With global inflationary surprises having caught most economists and central bankers off-guard over the past two years (“transitory” being the functional word), it is not hard to see why even now so many forecasts out there continue to point to moderation ahead; mostly back to the old norms before lockdowns, in the 0-3% that we have become so used to.

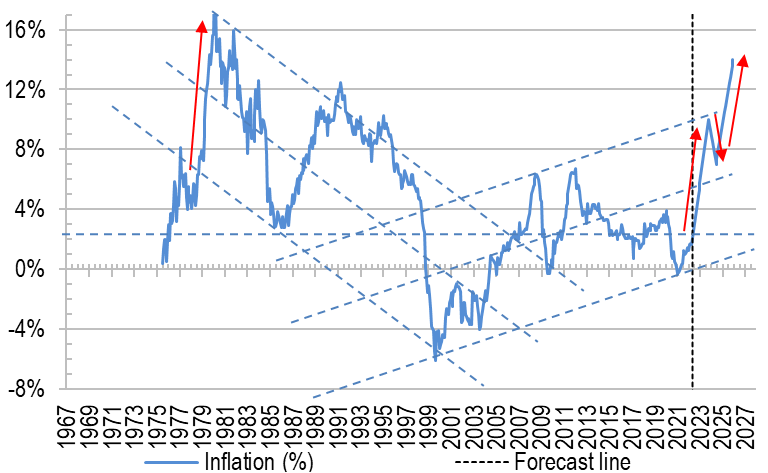

However, we argue that higher inflation will still beat expectations, and is likely to stay for longer still compared to popular expectations. In fact, a likely outcome might look like the 1970s when we had a previous (also energy price driven) inflationary cycle. Even a more modest trajectory that is above consensus but still below the 70s peak will take us into double-digit territory, looking something like this chart:

Chart 1: Inflation may surprise on the upside still

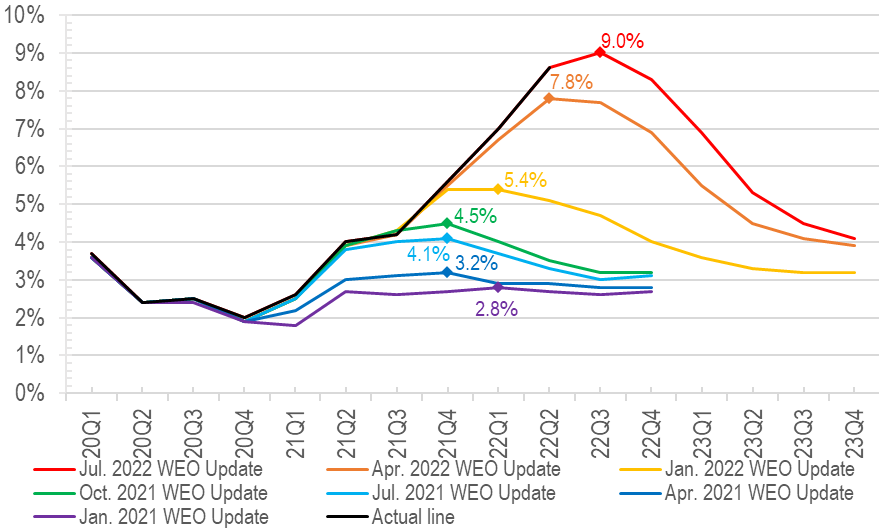

Perhaps it is human nature to project linearly and that has driven the constant under-estimation of inflation, as amply captured on the IMF forecasts here – going from Jan 21 forecast of a 2.8% peak by Q1 22 to progressively higher estimates which as of Jul 22 stands at 9% peak in Q3 22:

Chart 2: Successive IMF global inflation forecasts consistently underestimated both the magnitude and length of this cycle

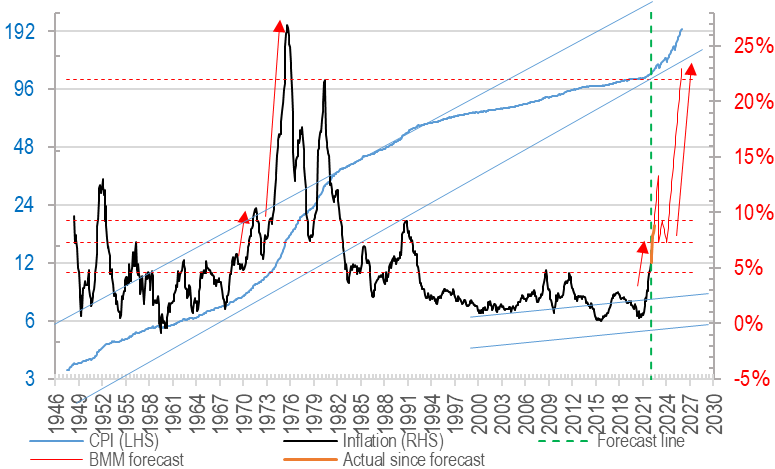

As readers familiar with our analysis may recall, back on 4th April 2022 when we went bearish on UK home prices, our ‘paranoid’ inflation forecast seemed unreachably high then, but unfortunately, this gloomy view has come true in subsequent actual readings, as tracked by the orange segment of the line in Chart 3 below:

Chart 3: our gloomy UK inflation outlook playing out faster than we thought

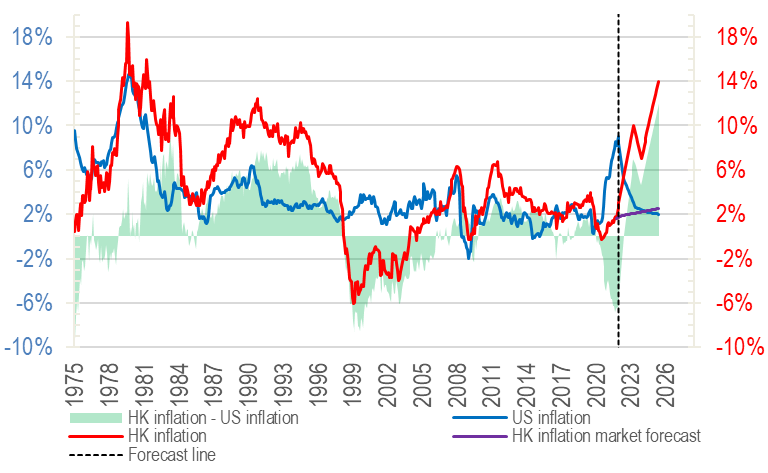

Whilst we do not wish to see an ultra-inflationary cost of living crisis hit HK as is ravaging most of the EU, as well as whole swathe of emerging market countries, we may have to prepare for a worse outcome than otherwise desirable.

So where can our worst-case outcome as depicted in Chart 1 go wrong? The biggest factor different from the 1970s is now HK’s peg to the US Dollar – whereas we saw much higher domestic inflation up till the peg was introduced in October 1983, HK had its own dynamics and inflation was exacerbated by a collapse in HKD of near 60% vs the USD in the wake of the Sino-British talks over HK’s handover.

Since then, the 90s boom resulted in a second inflationary wave before ending in the 1997 market crash – which led to a multi-year deflation period ending in 2003 (after SARS). After that, HK inflation pretty much tracked US moves but still benefitted from the influx of Chinese investment/consumer spending.

So now we are at the next inflexion point where even US inflation has shot through the roof (the latest July reading at 9.1%!) – will HK play catch up? Some possible factors that may contribute to such an outcome include:

- The current energy and food inflation cycle is global and no jurisdiction can escape;

- The super strong USD coupled with increasing geopolitical decoupling may trigger a de-peg of the HKD (a low near-term prospect but could become more realistic in 3-5 years’ time) importing more inflation rather than deflation;

- HK’s very prudent financial management may be reversed into a credit easing cycle (e.g., lower LTVs, permitting PRC property buying as part of the integration with the GBA) to fight a likely global recession;

- Further Zero Carbon policies compounding increased international conflicts (e.g., worsening Ukraine/Taiwan tensions, or worse, WW3) will add much more stress to supply chains and create yet more shortages and inflationary pressure in the next year or two;

The above scenario sounds very nightmarish, but we prefer to be mentally prepared for such an outcome rather than being caught unawares. It is in such a context that a comparison between the US and HK inflation becomes useful:

Chart 4: US vs HK Inflation – HK seems to magnify the US situation both on the up and down

With the market forecast for US inflation still wishfully (?) normalising to the 2% zone (blue line in the chart above), the likely surprise will again be on the upside. Likewise, the HK market forecast (purple line) is a very modest increase to the early 2% as well. We fear the combined forces of the inflationary drivers outlined above may actually drive the HK price rises much more like in the 70s this time round, and we could at worst be looking at double-digit rises come 2025-6 period as indicated above.

Impact of high inflation on rates

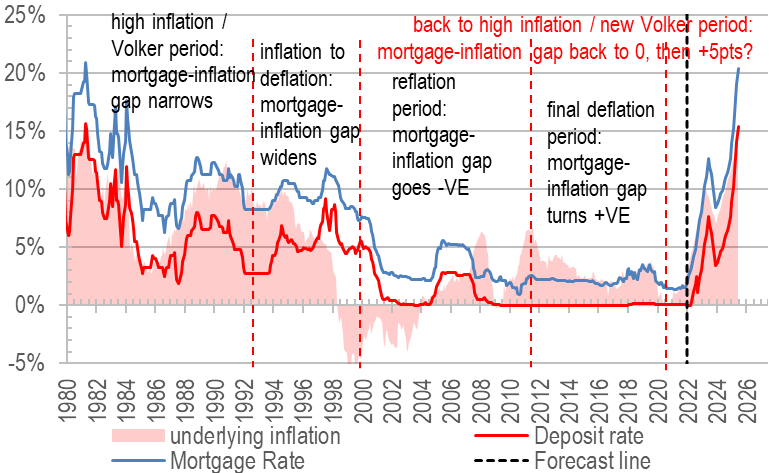

Inflation reaching >10% will sure push up local interest rates as well, as it always has done – looking at the relationship between HK mortgage rate and underlying inflation – the gap between the two has always swung from one extreme to the other. The chart below shows several such phases, with the last period 2011-2021 seeing mortgages going from below inflation levels to now at a small premium thereto.

Even if we assume mortgage rates keep pace with inflation, we could be staring at double-digit rates into 2024 if not more. At that time borrowers will probably all pray for a repeat of the 2000-2011 phase where rates traded below inflation, while savers will want to see the opposite.

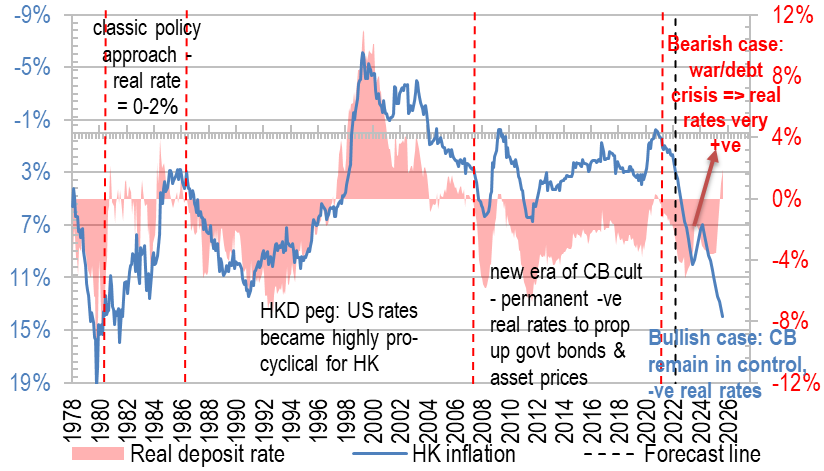

Chart 5: mortgage rate flips around inflation in multi-year swings

If the previous hyperinflation period returns in the next few years, we will more likely see interest rates rise above inflation –this time due to markets pricing in higher risk for bonds and much imminent default risks thereon, compared to the early 80s when higher rates were the results of inflation-beating rate hikes. In other words, central banks are likely to lose control of rates this time round (red arrow in Chart 6) given historically high debt levels compared to productive capacity, and the record scale of socialist manipulation of the economy at large compared to anytime in history.

Chart 6: Real rates may surge if confidence in central bank rate control is lost (when sovereign debt crisis erupts)

What we fear to most likely happen in the next few years include: a) inflation will not be cured by rate hikes (it is a supply chain driven phenomenon this time, not a demand push caused); b) sovereign debt crisis will finally erupt and cause a surge in risky rates (now government bonds will be the risky asset, not private sector yielding assets); and c) the upturn in war activities may push real rates even higher (Ukraine may be just the appetiser, could East Asia see its version of the crisis soon too?).

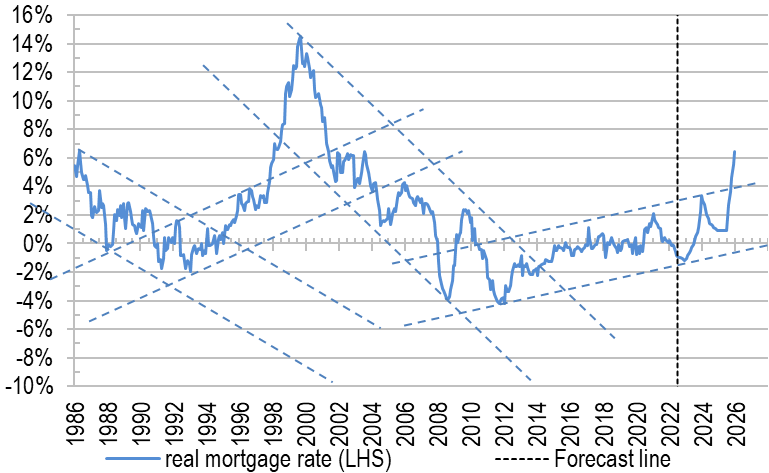

As a result, the simple extrapolation of past real interest rate cycles will not explain the price action in rate markets to come, in other words, we see real rates breaking above the very gentle rising channels that have been in motion since 2012 when global governments and central banks doubled down in their helicopter money printing to fund their unsustainable hand-out policies, and we could be seeing real rates surge to high single digits, as the chart below foretells:

Chart 7: Real mortgage rate could rise much higher in next 3-4 years

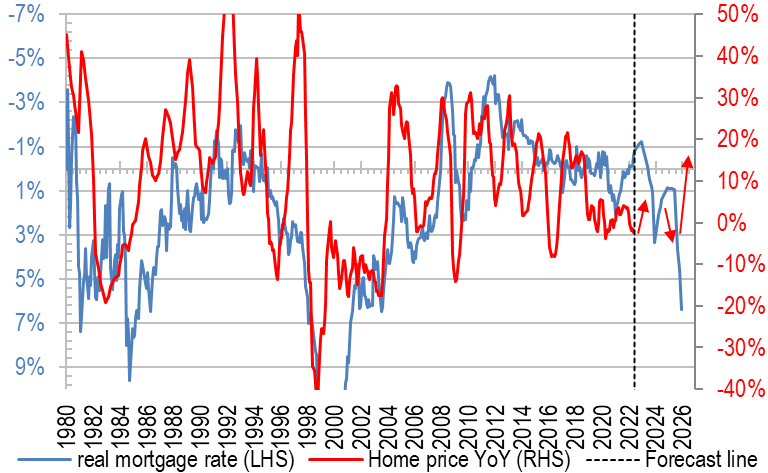

When real rates rise, home prices tend to suffer, even though in the short term the residual faith in central bank rate manipulation (i.e., keeping it low) will give some last momentum for a price rebound, the phase that follows may be initially panic to sell assets as debt crisis breaks out, which then turns round into a flight to quality in private assets (compared to government bonds), resulting in an unexpected surge in prices as a final hedge:

Chart 8: Real mortgage rate vs home prices

This kind of scenario would mean huge volatility in both rates and property prices, we wish owners/investors will have the holding power to not be thrown into making wrong buy/sell decisions at opposite ends of these possible violent gyrations in market conditions.

A trying time may indeed be upon us all, in all asset markets…