Is it time to buy HK retail property yet?

In the past two years, the retail market has been decimated by first the domestic protests and then by the global lockdowns.

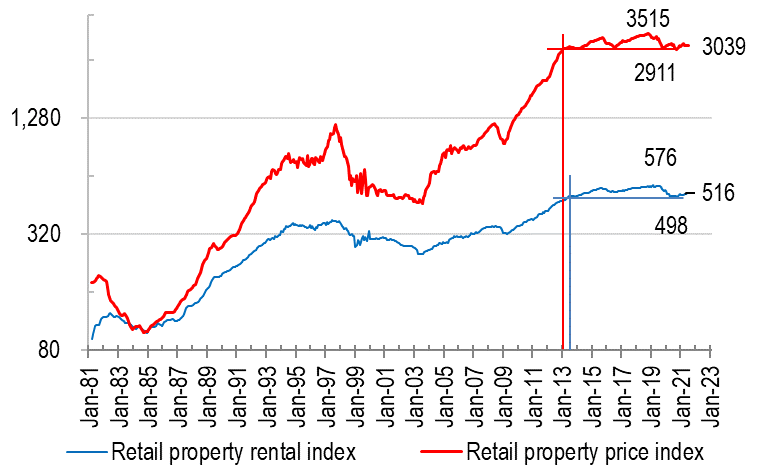

One of the prime victims of this combination of circumstances has been retail properties of Hong Kong, where rents have fallen some 14% from the 2019 peak, and is still down 8.9% even now (blue line in Chart 1). The drop in retail property prices were even more pronounced, down 17% peak to trough and now standing at 13% off the 2019 highs (red line in Chart 1).

Anecdotal reports of drops of 70-80% in prime street shop rents have also been common, indicating that formerly tourist hotspots have been far worse hit than the overall indices suggest.

Chart 1: Retail rents up 4x vs price surging 29x since 1984

Looking further back in time, however, both rents and prices have risen by multiples over recent decades, so the question remains – are these mere single-digit drops, which take us back to levels 7-8 years ago, enough of a correction for the current downturn?

Consumption drives rents, but interest rates hold sway of prices

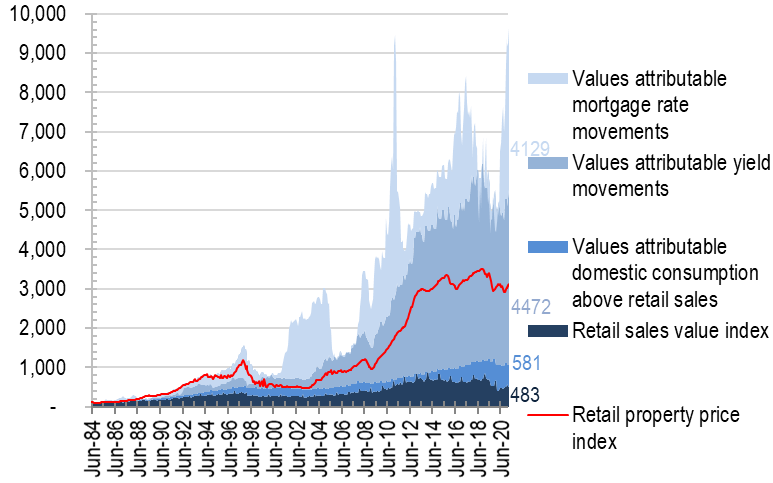

To explain the rise in retail property prices, we plotted on the same chart the various components that contribute to prices: a) retail sales (very dark area, Chart 2); b) domestic consumption beyond pure retail (dark area); c) change in property yields (light area); and finally d) financing costs as represented by mortgage rates (very light area):

Chart 2: bulk of price increase driven by yield compression

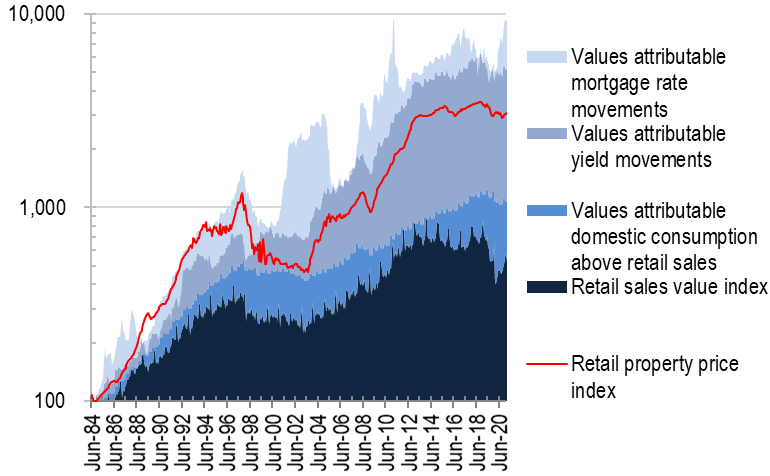

Chart 3: PRC shoppers drove 03-12 run up in retail, which reversed big time after 2019

It is clear from Chart 2 that the bulk of the contribution to retail price increases were yield compression, 4.2x the magnitude contributed by domestic consumption, but yields did not follow mortgage rate’s falls which would otherwise have doubled again the net impact on retail property prices. To view the various value drivers in a logarithmic view (all exponentially rising value series are best viewed this way ), the yield compression component remains highly significant (see Chart 3).

What Chart 3 also makes clear is how retail sales as a top line driver was boosted by opening of the PRC independent travel market in 2003, which propelled retail sales to almost equal total domestic consumption by 2012. However, this factor fell away rapidly after the 2019 protests and then the lockdowns in 2020. The changed retail habits in the lockdown era also decimated retail and pushed a lot of shopping activity online, which explains the widening gap between consumption and retail in the chart.

Rental underperformance compensated by drastic yield compression

In Chart 2 above, the difference between price (red line) and the yield compression implied price (top of light area) must be explained by rental not keeping up with increases in top line consumption takes. This kind of makes sense, as not all domestic consumption activities take place in retail premises – eg services, as well as online sales, take place in office or industrial space, or increasingly nowadays, in data centres, which are calculated under office/industrial rents but not retail rents.

Another way to illustrate this divergence is shown below:

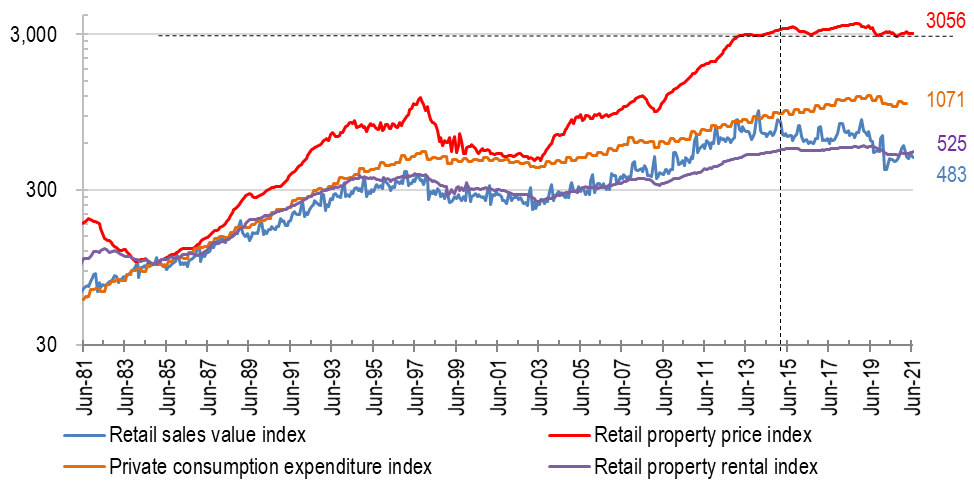

Chart 4: retail rent tracks retail sales, but not consumption

Here the rent index (purple line) tracks retail sales (blue line) very closely, proving that retail rent does indeed shadow retail specific activities and very little else – the fact they almost entirely overlap for almost all of the past three decades is impressive, and echoes our analysis above that rent has underperformed consumption (here represented by orange line) at large.

Retail property price – bit more rebound, then another leg down?

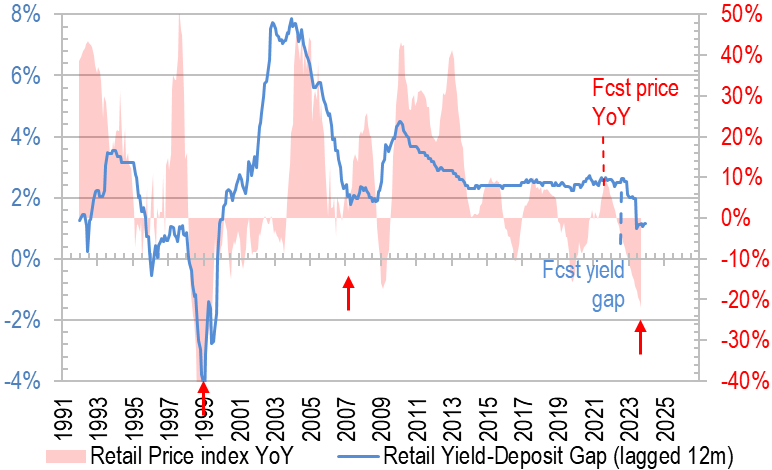

In our assessment, the current favourable tailwind of low interest rates and rental rebound from deep lockdown lows may peter out by late Q4 21 or early Q1 22, resulting in a topping out of retail property price growth by then:

Chart 5: Retail price likely to grow into end-21 before declining again as interest rates are likely to spike into 2023

Retail a safer bet than HK resi?

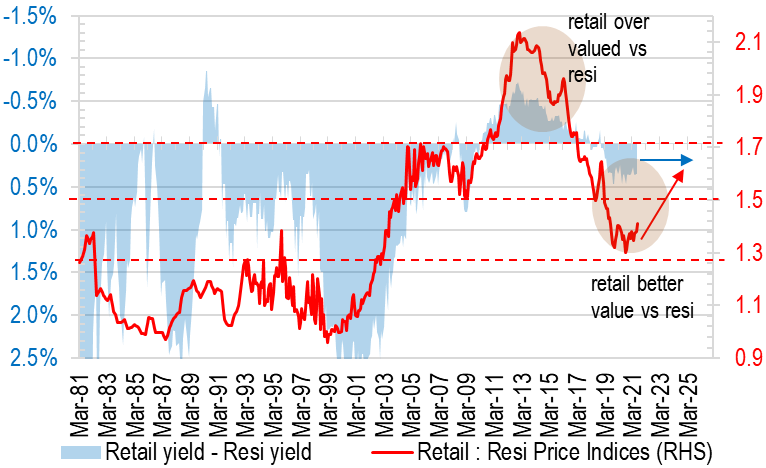

Despite possible bearish outcomes, retail property prices may still be in safer territory than HK residential for these reasons:

a) the lifting of lockdowns brings back PRC visitors, which will benefit foot traffic and retail rents more than residential rents;

b) the ability by PRC buyers to purchase HK flats has not evaporated as severely as retail spending in the past two years, thus will see less rebound post reopening;

c) HK’s high finance sector salaries that has sustained high residential rents may not see as much upside going forward (eg when interest rates rise and negatively impacting finance related incomes); and

d) residential yields are at historic lows and could expand even more than retail yields (blue area in Chart 6). These factors combine to provide more safety margin for retail property prices than residential prices, ie retail prices will likely outperform in the next year or two (red arrow in Chart 6):

Chart 6: Investing in retail properties seem to be a better decision than residential properties.

The ultra low yields in HK will be a big headwind to strong price appreciations ahead, especially in view of the lowest interest rates in all human history, coupled with a worldwide inflationary wave. Even so, retail property does not seem the worse amongst the various subsectors in HK property, given its recent corrections.

The author would like to thank Samson Leung of Hong Kong Baptist University and Jacky Chau of The Chinese University of Hong Kong for assisting in data collection, analysis, and drafting this article.