Your correspondent has made various comments in several media interviews relating to the budget measures. The most ‘uncut’ must go to the live interview on RTHK programme:

- 《理財新世代》 – 預算案全面撤辣是否有助樓市走出困局

listen to RTHK here or on my own Youtube, followed by

- Oriental Daily interview: 財赤嚴重勿只靠舉債 搞花招無助振經濟 (here) and then on the paper’s B1 section coverage, extracts of which reproduced here:

東方日報B1:大屋苑車位狂冧價 街舖蝕讓激增1.4倍 (link)

Bricks & Mortar Management主席兼總裁王震宇認為,息口高企,投資物業回報追不上存款利息,樓價難見起色,就算買部分高息地產股,回報也遠高於物業。假設租金上升,回報率要由約3厘上升至4.5厘,才可追近現時市場5厘息口。在息口未有回落情況下,整體樓市格局不會改變。

And finally

- Feature article text from iMoney front cover story (link):

《全徹辣 鬆按揭 樓市轉勢在望?》王震字:短時間反彈5%至7%

瑞銀前房地產研究領主管·Bricks & Mortar Management主席兼總裁王震宇說樓價已經去到極度超賣水平,相信短期內一定反彈,預計升5%至7%,但「可能第四季調頭向下」,又強調「若非中國『印銀紙』,美元這段時間弱,以及全世界覺得美國短期內不能加息,香港樓價很難反彈。不應該覺得今次樓價反彈,全由政府『撒辣』所致。」

他續說,「徹辣」雖令置業成本減少,但未必釋放很多購買力,「買樓的原因是因為覺得樓價會升。但如果樓價長遠仍跌,是不會有人因為成本少了,而擁入來買樓。」他又指經濟及政治環境才是左右樓市的主要因素,但前景不是得好,「中美角力這件事是最大問題,加上歐洲戰事令美元再升,令香港出口,或是賺匯能力會繼續跌下去。」

北水不會大舉重臨

部分本地買家或看淡經濟前景而無意置業,但今次「徹辣」不只本地買家受惠,海外買家也包括其中,稅率與港人睇齊。事實上,港樓向來受內地投資者歡迎,政府未推出「辣招」前,部分發展商甚至安排專車,接送內地買家來港睇樓。王震宇認為目前大形勢已改變,相信北水不會大舉重臨,「內地炒家也不想來香港,如果在港沒有資產,可能會有興趣,但如果已經來港,或有能力出資來港的,一早留意更遠的地方」

搶人才或成新動力

雖說北水難以大舉重臨,但政府過去一年積極搶人才,當中不少為中高收入人士,有望成為樓市新動力。王震宇明言,這些專才對樓市有些幫助,但暫時很難量化,又指如果「高才通」都是高資產人士,相信他們與投資者一樣都是看回報,「到底放錢落美元收息好,還是買樓收租,賺兩厘多回報?」

外圍環境複雜多變,世界經濟復甦速度不似預期,香港作為外向開放型的經濟體,難免受影響,樓市自然受累,但這是否意味香港樓市黃金時期已成歷史?王震宇認為,這視乎香港如何重拾競爭力,「暫時來說,美國的打壓不會放鬆」,而香港要避免財政儲備被慢漫陰乾,要找方法抵禦下個風浪,「不停發債不是一個解決方法。」

香港自保勒緊褲頭

被問到有何政府有何保救之法,他坦言可做不多,亦非香港可以控制,「現在打杖,怎樣保救?」」但建議政府避免破壞既有優勢,盡快減少過太多的福利及經常性支出,將編制減低,「要勒緊褲頭,未來一段時問是非常難頂的時候。」

他又說,今次《財政預算案》將香港簡單稅制摧毀得體無完膚,皆因薪俸稅本來是單一稅率,但將變成兩級制,又要實施差餉累進制,導致香港減低簡單低稅率優厚條件。更壞的是,政府推進落實經濟合作與發展組織(OECO)的稅率方案,令香港低稅率優勢失去,相信對香港長遠競爭力造成非常大的打擊。

王震宇說,目前樓價去到極度超賣水平,短期一定反彈,但受外圍環境影響,而且非香港可以控制,所以樓市長遠始終不穩,「如果以6個月為期限,就是入市時機,但若看遠一點就不好」,無論是投資者,抑或買家,情況亦一樣。他又建議,若打算賣樓套現,可以「趁高鬆綁」。

As we keep emphasising, the poorly thought out decimation of HK’s simple and low tax system is the biggest concern from this year’s budget, followed by a departure from HK’s traditional prudent financial disciplines – more welfare spending, zero scaling back of government expenditures, which resulted in the need to raise large amounts of new debts. No wonder former Financial Secretary John Tsang is also worried (see:曾俊華憂香港將要借貸度日)

Below was our original comment on the say of budget speech, plus extracts of relevant texts from the speech:

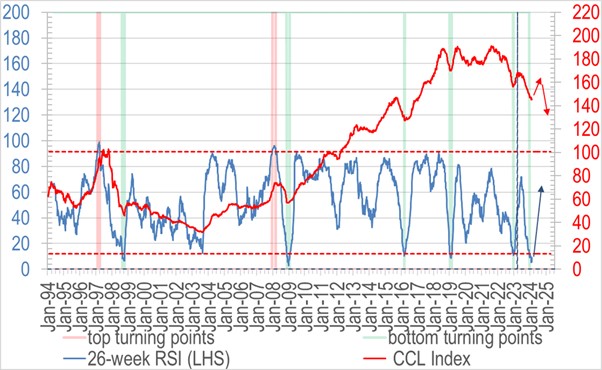

Very simply, the various property support measures come at a time when Chinese credit easing, temporary pause in US rate hikes, and technically oversold condition in local property prices (RSI at multi-year low):

This suggests whatever budget measures will only add to the bigger picture favourable tail winds. In the next 6-9 months, expect high single digit rebound in home prices and volumes, but by late 2024 we think the resuming USD strength and European wars to again weaken local property demand, with possible finish by early 2025 at levels below current prices.

Extracts of budget speech below, with emphasis from your correspondent, and comments in []:

————most disappointing measures relating to HK’s tax system——————

- …implement a two‑tiered standard rates regime for salaries tax and tax under personal assessment starting from the year of assessment 2024/25. … the first $5 million of their net income will continue to be subject to the standard rate of 15 per cent, …portion exceeding [at] 16 per cent. It is expected that about 12 000 taxpayers will be affected, accounting for 0.6 per cent of the total number of taxpayers … revenue will increase by about $910 million each year.

[for a puny little increase, why destroy HK’s simple income tax regime?]

- …implement the progressive rating system for domestic properties, …effect from the fourth quarter of 2024‑25 onwards. …properties with rateable value over $550,000, which account for about 1.9 per cent of the relevant properties. It is estimated that the system will contribute to an increase of about $840 million in government revenue annually.

[for another puny increase, why destroy HK’s simple rates system?]

- …global minimum tax …by the OECD to address base erosion and profit shifting. …apply the global minimum tax rate of 15 per cent on large multinational enterprise groups with an annual consolidated group revenue of at least EUR 750 million and impose the Hong Kong minimum top‑up tax starting from 2025. …bring in tax revenue of about $15 billion for the Government annually starting from 2027‑28.

[for rubbing shoulders with mostly overleveraged / wanton spending bureaucrats elsewhere this is a big loss for HK’s competitiveness (yes I know the pressures of being put on ‘grey lists’ etc – get big bro China to back us instead of bowing to profligate tyrannies elsewhere might be a better option?]

———————-other important initiatives————————–

Re-domiciliation Mechanisms

36… putting in place user‑friendly fund re-domiciliation mechanisms for Open-ended Fund Companies and Limited Partnership Funds. … will submit a legislative proposal enabling companies domiciled overseas, especially enterprises with a business focus in the Asia-Pacific region, to re-domicile in Hong Kong.

Lifting all punitive stamp duties

- …cancel all demand-side management measures for residential properties with immediate effect, that is, no SSD, BSD or NRSD needs to be paid for any residential property transactions starting from today.

Likely lifting of LTV/DSR restrictions too

- …now room to make further adjustments to …property lending …The HKMA will make announcements later today.

Deduction of Expenses and Allowances under Profits Tax

- …Profits-tax payers will be granted tax deduction for expenses incurred in reinstating the condition of the leased premises to their original condition. …the time limit for claiming the allowances will be removed. This will allow the new owner to claim allowances for the property after a change of ownership …take effect from the year of assessment 2024/25. [seems applicable to new purchases rather than new tenancies for existing owners – impact limited]

Tax / rates concessions

72.

(a) rates concession for domestic properties for the first quarter of 2024/25, subject to a ceiling of $1,000 for each rateable property;

(b) rates concession for non‑domestic properties for the first quarter of 2024/25, subject to a ceiling of $1,000 for each rateable property;

(c) reduce salaries tax and tax under personal assessment for the year of assessment 2023/24 by 100 per cent, subject to a ceiling of $3,000. …This measure will benefit 2.06 million taxpayers and reduce government revenue by $5.1 billion;

(d) reduce profits tax for the year of assessment 2023/24 by 100 per cent, subject to a ceiling of $3,000. …benefit 160 000 businesses and reduce government revenue by $430 million; and

(e) allowance to eligible social security recipients, equal to one half of a month of the standard rate Comprehensive Social Security Assistance (CSSA) payments, Old Age Allowance, Old Age Living Allowance or Disability Allowance, while similar arrangements will apply to recipients of the Working Family Allowance, altogether involving an additional expenditure of about $3 billion.

Lower bribes for EVs

- The first registration tax (FRT) concessions for electric vehicles, due to terminate at the end of March, will be extended for two years. …will reduce the concessions by 40 per cent. …At the same time, e‑PCs valued at over $500,000 before tax will not be entitled to concessions [good to see govt stepping back from mad rush to net zero, but can do more – scrap all concessions!]

‘high’ tech grants everywhere – really should scale back?

[109 & 113 & 119 & 123…. $3bn to Cyberport, $6bn to universities on biotech, $10bn on New Industrialisation Acceleration Scheme (NIAS), $2bn on InnoHK research clusters, etc… blind throwing of money at problems that may not need govt intervention? ]

HK to consolidate its #1 RMB hub status

- As the world’s largest offshore RMB business hub, Hong Kong processes about 75 per cent of global offshore RMB settlement. We also have the world’s largest offshore RMB liquidity pool, at over RMB 1 trillion.

Lower patent tax

- …amend the Inland Revenue Ordinance …implementing the “patent box” tax incentive, which will reduce substantially the tax rate for profits derived from qualifying IP to five per cent.

Increase ship register in HK

- In addition, Hong Kong’s ship registration regime is widely recognised internationally. Hong Kong ranks fourth in the world in terms of gross tonnage, …port state control detention rate of Hong Kong registered ships is much lower than the global average. …to offer block registration incentive to attract shipowners to register ships in Hong Kong extensively. The Government will amend the relevant regulations regarding this incentive starting this year.

Oversupply of public housing continues: 31k vs 16k private p.a. starter home collapse to continue

- We will make available land for the production of no less than 80 000 private housing units in the coming five years.

- On public housing supply, the Government has identified sufficient land for meeting the supply target of 308 000 public housing units over the next ten years (from 2024‑25 to 2033‑34).

No sign of fiscal restraint, big disappointment

- Total government expenditure for 2024‑25 will increase by about 6.7 per cent to $776.9 billion, with its ratio to nominal GDP projected to increase slightly to 24.6 per cent.

- Recurrent expenditure will increase by seven per cent to $580.2 billion. Of this, substantial resources will still be allocated to livelihood‑related policy areas including health, social welfare and education, involving a total of $343.7 billion, representing 59.3 per cent of recurrent expenditure.

- …will be a deficit of $48.1 billion for the year, and fiscal reserves will decrease to $685.1 billion. [time to take back many crowd pleasing non-means tested giveaways – eg the Joy You scheme)

- In 2024‑25, the Government will maintain its target of zero growth in the civil service establishment. [should cut civil service size!]

[whilst forecasting 26/27 budget surplus, we believe this is overly optimistic, including on land sale projections as well as not factoring in global geopolitics]

So there you have it, short term asset positive, but may be a good opportunity to lighten up given decoupling uncertainties in the wider macro environment…